Business

Conventional loan home condition requirements: What you need to know

When navigating the complex terrain of buying a home, understanding the nuances of conventional loan home condition requirements is essential. Conventional loans, which are not insured by government agencies like the FHA, VA, or USDA, often come with specific prerequisites regarding the property’s condition. These standards are set to ensure the home is a safe, sound, and sanitary place to live, safeguarding both the lender’s and borrower’s investments.

This comprehensive guide delves into the conventional loan home condition requirements, offering insight and clarity to prospective homebuyers and real estate investors alike.

Introduction to conventional loan home requirements

Conventional loans are a popular financing option for homebuyers due to their flexibility and the potential for lower interest rates and private mortgage insurance (PMI) costs. However, these loans have stringent condition requirements that the property must meet. Understanding these requirements is crucial for a smooth home buying process.

Property appraisal and condition assessments

Here are the property appraisal and condition assessments that you need to have in mind:

The role of the appraisal

An appraisal is a critical component of the conventional loan process, serving two primary purposes: determining the property’s market value and assessing its condition. Lenders require an appraisal to ensure the property is worth the loan amount and meets specific safety and habitability standards.

Key conventional loan home condition requirements

Conventional loan home condition requirements can be extensive, focusing on the property’s overall safety, soundness, and sanitation. Some of the primary areas of concern include:

- Structural integrity: The home must be structurally sound, without any significant damage or defects that could affect its stability or safety.

- Roofing: Roofs should have a reasonable remaining life expectancy, typically two to three years, with no major leaks or damages.

- Plumbing, electrical, and HVAC systems: These systems must be in good working order, with no significant safety hazards or deficiencies.

- Lead-based paint: For homes built before 1978, any peeling or chipped paint must be investigated and remediated if lead-based.

- Pest infestation: The property should be free from significant pest infestations that could affect the structural integrity or livability of the home.

Navigating home repairs and renovations

If a home does not meet the conventional loan condition requirements, repairs or renovations may be necessary before the loan can be approved. Buyers and sellers can negotiate who will be responsible for the cost of these repairs. In some cases, lenders may allow escrow holdbacks, where a portion of the loan funds is held back until the necessary repairs are completed after closing.

The importance of home inspections

While not always a requirement for conventional loans, home inspections are highly recommended. A thorough inspection can identify potential issues that could require immediate repair or pose problems in the future. Understanding the difference between a home inspection and an appraisal is crucial; an inspection provides a more detailed examination of the home’s condition.

Preparing for the loan application process

Prospective buyers should prepare for the loan application process by gathering necessary documentation and ensuring their financial profile is strong. This preparation includes understanding credit score requirements, down payment expectations, and debt-to-income ratios. Additionally, buyers should be ready to address any property condition issues upfront, potentially saving time and frustration later in the process.

Tips for a smooth loan approval process

- Work with a knowledgeable real estate agent who understands conventional loan requirements and can guide you in selecting a property that meets these standards.

- Budget for potential repairs and renovations that may be necessary to meet loan condition requirements.

- Be proactive about addressing condition issues with the seller before finalizing the purchase agreement.

- Communicate openly with your lender about any concerns or questions regarding the property’s condition and how it might affect your loan approval.

Conclusion

Navigating the conventional loan home condition requirements can be a daunting aspect of the home buying process. However, with a thorough understanding of what lenders are looking for and proactive preparation, buyers can ensure they are well-positioned to secure financing for their new home.

By focusing on the property’s safety, soundness, and sanitation, and being prepared to address any issues, prospective homeowners can move forward with confidence, knowing their investment meets the necessary standards for a conventional loan. Remember, the goal of these requirements is not only to protect the lender’s investment but also to ensure that buyers are purchasing a home that is safe and enjoyable for years to come.

-

Lifestyle4 weeks ago

Lifestyle4 weeks agoHow to lay pavers: A step-by-step guide

-

Sports1 month ago

Sports1 month agoHunting gear list: Essential equipment for a successful hunt

-

Tech4 weeks ago

Tech4 weeks agoWhere to buy electronic parts: A comprehensive guide

-

Business4 weeks ago

Business4 weeks agoWarehouse safety tips: Ensuring a safe working environment

-

Entertainment4 weeks ago

Entertainment4 weeks agoBest comic books

-

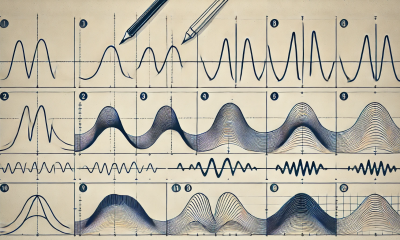

Entertainment2 weeks ago

Entertainment2 weeks agoHow to draw a waveform: A step-by-step guide

-

Tech2 weeks ago

Tech2 weeks agoChromecast turning off: Causes and solutions

-

Lifestyle3 weeks ago

Lifestyle3 weeks agoExterior home design: Transforming your home’s curb appeal